Are you looking for the best state in the United State to start your entrepreneurship? Look no further. This article will provide you with the ultimate insights on the best and worst states to start a business based on factors like business regulations, Tax climate, cost of living, growth potential, etc…

- Factors that determine the best state to start a business in 2024

- Top 10 Best States to start a business in America 2024

- 1. Texas – The Overall Best State

- 2. Montana – Best State for business friendliness

- 3. Georgia – Best State Choice for Cost of Labor

- 4. Utah – Best State for Business Financing

- 5. Florida – Best State to Start your Business for Tax Purposes

- 6. California – Best State for Innovation

- 7. Oklahoma – Best State for Cost of Doing Business

- 8. North Carolina – Best State for Starting a Limited Liability Company (LLC)

- 9. Delaware – Best State for Your Privacy Protection

- 10. Idaho – Best State for Real Estate

- 5 Worst States to Start a small business in 2024

- What We Considered to Rank the Best and Worst States for Starting a Business

- Conclusion

Ready to make your entrepreneurial dreams come true? You’re not the only one. According to the United States Census Bureau, millions of Americans file for business applications each year. 2021 even set a record for the new business applications filed in any given year – 5.4 million, based on Business Formation Statistics!

If you’re ready to pursue your entrepreneurial dreams and launch a business, you may be wondering which states are the best choices. Taking into account the most up-to-date data from the United States Census Bureau, we’ve compiled a list of the top states for starting a business in 2024. From tax incentives and infrastructure to financing assistance and start-up support, each of these states has something special to offer aspiring entrepreneurs. So, if you’re considering a change in career or looking to start a business, read on to find out which states provide the best combination of environment and opportunity!

Factors that determine the best state to start a business in 2024

Where you currently reside

If you’re running a business that operates in multiple states, the best place to start your registration process is typically the state where the business has its main physical presence or where the founders reside. This offers three primary advantages:

1. Qualifying your business in another state may involve additional time and expense which could counterbalance any potential benefits of registering in the first state. For example, registering your company in a low-tax state but having to pay a $600 foreign corporation fee annually and filing an extra annual report each year.

2. Business owners are likely more familiar with their home state’s tax requirements and may have preexisting relationships with accountants or tax advisers who can provide guidance.

3. It can be easier for business owners to operate their business bank accounts at the same bank where they have their personal accounts.

In addition, registering in each state where your business operates will ensure that you are compliant not just with federal law, but also with that particular state’s regulations and requirements. Depending on where your business is located, this could also include obtaining licenses from individual counties or municipalities. Before going through any new registrations, it’s always beneficial to consult with a qualified tax adviser to get further information about the specific requirements of your business.

States Business regulations

It can be difficult to operate in states with more rigorous business regulations – even opening your business might require multiple licenses. California, for example, requires a different license for each stage of CBD production: cultivating, manufacturing, distributing, and selling.

This means additional expenses, some of which might need to be paid annually. Some states also have costly zoning requirements, hiring policies, and health, safety, and environmental regulations that add further complexity. To make compliance easier, here are the five states with the strictest business license compliance: Alabama, California, Florida, Virginia, and Tennessee.

With the coronavirus pandemic changing life forever, understanding the safety protocols established by state governments is essential if you want to remain compliant. Here are the five states or districts with the most Covid-related restrictions: Virginia, Vermont, the District of Columbia, Hawaii, and California. Knowing and following these regulations can keep your business running smoothly and prevent legal action from being taken against you.

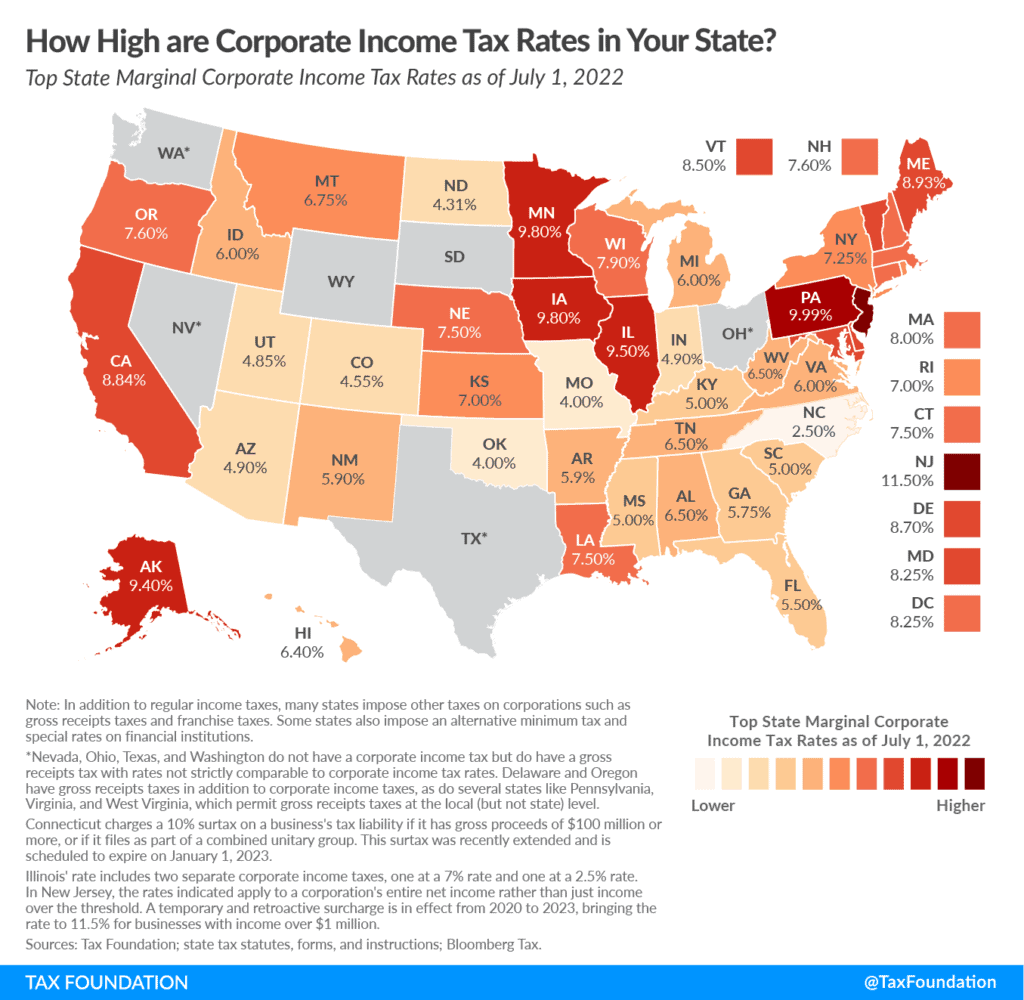

Tax climates in each states

When choosing where to start a new business, evaluating the local tax policies of each state is crucial. Different states have different corporate, personal income, sales, and property taxes that can impact your overall rate of business. When researching potential states, don’t solely focus on the corporate tax rate. Consider all aspects of taxation including personal income taxes, sales taxes, and any other special taxes in the area. These taxes may be more complex or have higher rates than the simple corporate tax rate indicates.

Consider also how each state’s tax breaks or incentives could benefit your business. Many states offer tax abatements or credits for certain industries or those meeting certain criteria – you could use this to lower your rate of business even further. Additionally, some states exempt certain types of businesses from taxation altogether while others grant deductions against taxable income. This can create an environment conducive to launching a successful business venture.

It pays to do your research before launching a business in any particular state – understanding the tax implications can make all the difference when it comes to keeping your business costs low and increasing your profits.

Cost of living and expenditures

Business formation fees are an often overlooked initial expense for first-time entrepreneurs, but it’s important to know that these fees can vary significantly from state to state. Depending on the state you’re doing business in, you could pay anywhere from $100 to several thousand dollars. It’s a one-time cost, so make sure you research what states offer the most appealing costs and regulations before making a decision.

Once you’re registered, you’ll want to keep an eye on annual compliance fees as well. Although not all states require year-round filings, many do need periodic licenses or certifications. Costs associated with these documents can affect your budget over time, so take those into consideration when creating a long-term plan.

It’s worth noting that some states may have unfavorable business laws and regulations which can deter potential investors, lowering your chance of raising funds from venture capitalists down the line. Therefore, you should consider any taxes and business fees when choosing where to base your operations.

Of course, there are other business expenses to take into account. Equipment and inventory costs are two examples that you should plan for, as well as delivery fees if you plan to ship products. Many business expenses are tax deductible, which can be helpful for those in high-tax states. Do your due diligence and make sure you’re aware of all potential costs before investing significant resources in setting up a shop in a certain location.

Business Growth potential

As you’re searching for the perfect place to establish your business, investigate the state’s workforce and whether it can sustain your product or service. Make sure to check out the United States Bureau of Labor Statistics to gain insight into the labor force’s current status.

Additionally, exploring the possible competing businesses is key – too many could suggest saturation, but not enough would be indicative of a lack of demand. Finally, research the population of the city and its neighboring areas to gauge if it’s growing, decreasing, or stable; City-Data.com provides detailed information on population, income, education levels, and other demographics. To make the best decision, be sure to arm yourself with helpful and reliable facts!

Top 10 Best States to start a business in America 2024

We’ve examined a broad set of criteria to make sure every state has an equal opportunity to compete for the best environment for business success. We delved into reports by federal and state governments, external research studies, and insights from entrepreneurs nationwide to determine which states present the best launching pad for startups. Our findings are unbiased and dependable, coming from a highly reliable source.

So, if you’re starting a venture, this information will help you focus your search on states primed to provide what your business needs.

1. Texas – The Overall Best State

Pros of starting a business in Texas

Texas is the best state for business due to its favorable business climate, strong labor force, and burgeoning economy.

With no personal or corporate income tax ( but imposes a 6.25 % state sales tax ), entrepreneurs looking to incorporate their businesses in Texas will find an attractive taxation rate. The Lone Star State also boasts a well-developed infrastructure, a low risk of natural disasters, and a high number of cities and universities providing access to a large labor pool with both young and highly skilled employees.

Since Texas is the second-largest state by population, it has seen tremendous growth in recent years, including a 7.7% increase in the working-age population over five years and the second-highest GDP growth rate among U.S. states. Small businesses are flocking to Texas due to its many advantages, such as the low tax burden and ample resources available to start up a company.

Plus, many companies have experienced success in Texas due to its high survival rate and abundant opportunities for growth. With over 2.7 million small businesses currently active within Texas’ borders, entrepreneurs of all backgrounds can take advantage of this large and diverse customer base.

Finally, with its central location in the United States, Texas presents easy access to extensive transportation networks for shipping out products or services. Overall, it remains one of the best states for commercial activities due to its hospitable business environment, an abundance of untapped resources, and many other factors.

Cons of starting a business in Texas

One of the biggest drawbacks of starting a business in Texas is the cost of running a business here. Texas has some of the highest property taxes and sales tax rates in the country, making it more expensive to operate a business here than in some other states. Additionally, the cost of living in Texas is higher than average with housing costs being especially high in large cities like Houston, Austin, and Dallas.

There are countless reasons why entrepreneurs and small business owners should consider making their home in the Lone Star State. With its business-friendly performance on all fronts, Texas offers unparalleled opportunities to new businesses looking to succeed in today’s market.

2. Montana – Best State for business friendliness

Pros of starting a business in Montana

Starting a business in the Treasure State is no small decision. But the advantages that Montana offers make it an attractive option for entrepreneurs looking to put down roots in an outstandingly beautiful and business-friendly state.

For starters, Montana has a zero state sales tax which can be hugely beneficial for startups, especially those selling products. It also enjoys a fast-growing economy and very reasonable labor costs, with the second-lowest real labor compensation in the US at just $31.56 on average. Business owners need not worry about climate disasters either, as safety from them is another plus point of operating their business in Montana.

But perhaps the most attractively unique benefit of starting a business in Montana is its zero income tax rate which may be a deciding factor for some in taking the plunge into entrepreneurship. A low cost of living combined with an exceptional workforce makes employee retention much higher than in other states. At the same time, the quality of life in Montana adds an extra incentive when it comes to setting up shop.

What’s more, Montana consistently shows a five-year business survival rate of over 53.4%, revealing that operating a business here is indeed a worthwhile investment. With all these features taken into consideration, an entrepreneur won’t regret taking their chances by opening their own business in the treasure state.

Cons of starting a business in Montana

Starting a business in Montana has both its pros and cons. On the one hand, Montana is a very business-friendly state, giving entrepreneurs the freedom to start their businesses without too much bureaucracy or unnecessary hurdles. The corporate income tax rate, at 6.75%, isn’t the best, but it’s also not too bad either. Furthermore, the cost of starting a business in Montana, as well as the ease with which all necessary paperwork can be completed, make it an attractive, and relatively inexpensive option for those looking to open a new business.

On the other hand, while some businesses may thrive in Montana due to its rural nature (such as agri-businesses and tourism), others may struggle due to the lack of consumer spending compared to states like Texas and Utah. Additionally, businesses operating out of Montana do suffer from higher energy costs and slower internet connection speeds than in other states, making access to resources and communication more difficult.

Overall, suppose you are contemplating starting a business in Montana. In that case, you will want to weigh your options carefully and evaluate whether your business is likely to benefit from the benefits the state offers in terms of setting the stage for growth and success.

3. Georgia – Best State Choice for Cost of Labor

With the abundance of support and resources available, starting a business in Georgia is an attractive option for many entrepreneurs. The state boasts robust infrastructure and a prosperous economy, making it a great spot to grow and develop businesses.

Pros of starting a business in Georgia

For those looking to start a business in the Peach State, Georgia has a lot of great advantages over other states:

- Well-developed infrastructure with easy access to capital, airports, and highways;

- A strong economy fueled by a skilled workforce and multiple sectors including technology, manufacturing, and finance;

- Venture capital at its highest level can be attained here. This is an opportunity to make the most of your investment and gain the greatest possible return..

- Employers in this state benefit from favorable payroll regulations and enjoy some of the lowest minimum wage requirements in the country, making it easier to manage their workforce.

- 5.75% individual and corporate income tax rate;

- Low cost of living;

- An emerging tech hub, Atlanta is attracting more investments into startups;

- A working population of 5m+ people, with an average salary of $50,097;

- Low registration fees between $125-225 (domestic and foreign);

- A survival rate for small businesses of 76.12%.

- 112 companies being invested in, receiving $10.2 million each on average ($1.14 billion total).

These advantages make it clear that Georgia is an excellent choice for aspiring entrepreneurs. With so much potential to take advantage of, now is the perfect time to launch your business in the Empire State of the South.

Cons of starting a business in Georgia

Not only is there an initial and yearly fee required in order to establish and maintain your LLC, but you may also be subject to other types of payments. One of those potential expenses may be a registered agent fee. A registered agent is required for all LLCs in the state of Georgia, which can range from $40 to $500 per year depending on who you hire. Furthermore, corporations, LPs, and LLPs will also need to appoint a registered agent.

A significant disadvantage of forming an LLC in Georgia is that you will incur additional fees, such as the $25 fee to apply for a business name reservation and a recording fee of $100. In addition, LLCs are required to pay an annual registration fee of $50 for partnerships in Georgia.

Additionally, if you choose to elect C corporation or S corporation taxation on your LLC, you will be subject to both Georgia’s corporate income tax and net worth tax. The corporate Georgia LLC tax rate is six percent of Georgia taxable income, with the net worth tax being assessed if the net worth of the LLC is more than $100,000.

4. Utah – Best State for Business Financing

Pros of starting a business in Utah

The Beehive State currently has the second-highest growth rate for new small businesses and was named the No.1 state for entrepreneurial activity in 2020.

According to SeekCapital, 101 businesses received roughly $11.5 million in venture capital funding for a total of $1.16 billion invested in 2019 — making it amongst the highest recipient states in the country. What’s more, there is a healthy labor supply, a supportive regulatory environment, and easy access to business financing here.

The tax environment in Utah is especially advantageous for small business owners. The corporate income tax rate is only 4.95%, which was lowered from 5% in 2018. This low rate has encouraged countless startups and entrepreneurs to settle in the state every year.

Thanks to its pro-business and fast-paced economy, Utah is experiencing immense population growth and shows no signs of slowing down. With 9% working-age population growth in the last few years, Utah is a prime location for entrepreneurs who want to make a lasting impact on the world.

Cons of starting a business in Utah

On the one hand, Utah’s consumer spending is great; its five-year business survival rate of almost 50 percent speaks for itself when it comes to business sustainability.

On the other hand, the cost of labor and the overall cost of doing business can be prohibitive to new entrepreneurs. Many small business owners find that they must pay much higher wages than in other states, forcing them to invest more money into each employee just to keep up with the competition.

5. Florida – Best State to Start your Business for Tax Purposes

Pros of starting a business in Florida

Florida is quickly becoming a popular place to launch small businesses. It has no state income tax for individuals and only a 5.5% corporate income tax rate, making it one of the best states in the country for small businesses when it comes to taxes. Furthermore, many other types of state taxes are very low in comparison to other states. If you’re thinking of starting a business in Florida, the cost is relatively affordable as LLCs cost $100 and limited partnerships come with a price tag of only $965.

If you decide to start your business in Florida, you can also benefit from some of the lowest real labor compensation costs per hour of any state, giving your business an extra boost. Additionally, businesses that start in this sunshine state usually require an average startup investment of just $5000, making the barrier to entry more attainable. Many businesses have been successful and have gone on to create 6.41 jobs within their first year. As long as your business isn’t structured as a C corporation, you won’t have to pay any state income taxes in Florida either.

The cost of living in Florida may be slightly higher than the national average, but that’s balanced out by a large, talented labor force of 10.5 million people with an average salary of $55,833 — an impressive number compared to similar states.

Cons of starting a business in Florida

Despite its sunny beaches and beautiful landscapes, the reality of doing business in Florida is that it can be a difficult place to succeed. The five-year business survival rate in the Sunshine State stands at 49.5%, so more than half of the small businesses don’t find long-term success here. Additionally, Florida is prone to natural disasters, making it an uncertain place to conduct business.

As a result, it’s important to understand the risks associated with starting a business in Florida before diving in—but there are also some clear benefits. Plant City, Florida has some of the lowest labor costs compared to other parts of the country, and many parts of the state have access to capital for funding.

That being said, forming a corporation often requires a significant amount of paperwork. To make sure everything goes smoothly throughout the process, it’s recommended that entrepreneurs retain legal counsel experienced in Florida law. Depending on the complexity of your business structure, setting up a corporation could initially cost between $500 and several thousand dollars.

All in all, while Florida is far from perfect, it still provides a viable option for those seeking to pursue their entrepreneurial dreams.

6. California – Best State for Innovation

Pros of starting a business in California

Starting a business in California can be a great opportunity for entrepreneurs. But there are pros and cons to consider before taking the plunge. The good news is that California offers natural advantages for businesses—including access to venture capital, an innovative and highly skilled workforce, and the second-highest rate of new businesses formed in the country. With such attractive perks, it’s no wonder why 53 Fortune 500 companies have based their headquarters in the state.

Despite higher costs, business owners have a few incentives at their disposal that may help to offset the cost of doing business in California. For example, qualifying businesses may be eligible for job creation credits or domestic production activities deductions. It’s also worth noting that while California has one of the highest rates of new entrepreneur formation, it also has one of the highest rates of small business survival after its first year—82.56%. This is likely due to the amount of venture capital available here; in 2021, nearly $27 billion was invested in 2,869 businesses.

This statistic should give entrepreneurs some peace of mind when deciding on launching a venture within the Golden State.

Cons of starting a business in California

But starting a business in California has its downsides. California has some of the highest costs associated with doing business in the US. This includes corporate taxes at 8.84%, as well as high personal income tax rates ranging from 1% to 12.3%. It is important to keep these costs in mind when running the numbers of your business plan.

7. Oklahoma – Best State for Cost of Doing Business

Pros of starting a business in Oklahoma

Deciding to start a business in Oklahoma has many benefits, and if you’re looking for an ideal place to start your business journey, the Sooner State might be just the right fit.

The state of Oklahoma is known for having one of the most business-friendly climates in the country, making it a fantastic option for entrepreneurs looking for a great place to launch their ventures. One of the first advantages of starting a business in Oklahoma is its low cost of doing business – businesses in the state have some of the lowest operational costs from taxes to insurance in the entire US. This can provide startups with valuable resources to make sure they get off to a strong start.

Another significant advantage of setting up a shop in Oklahoma is its high business survival rate; almost 82% of all new businesses survive their first year, and close to 50% survive for five years. It’s also worth noting that the ratio of entrepreneurs to the population in Oklahoma is higher than the national average. This may suggest that more people are finding success in launching their businesses there.

Finally, Oklahoma has some key infrastructure in place to help encourage entrepreneurs – including several small business organizations, tax incentives, and government programs that offer education and advice to budding business owners. All this creates a friendly and welcoming environment which makes starting a business much easier.

Cons of starting a business in Oklahoma

Oklahoma is a great place to start a business, but it has its drawbacks that entrepreneurs should consider. The state has the longest average workweek in the US, meaning employees work more hours for lower wages. This can make it harder to attract and motivate skilled workers, leading to a less-skilled workforce overall.

Additionally, consumer spending in Oklahoma is one of the lowest in the US, which means there are fewer opportunities for businesses to reach customers. Finally, while venture capital is available, the low population density and lack of regional identity make it difficult for startups to generate interest from outside sources.

Despite these drawbacks, Oklahoma remains one of the top states for starting a business due to its relatively low operating costs, tax breaks, and access to resources. Business owners should approach each decision with an informed perspective in order to make the most of the opportunities this state can provide.

8. North Carolina – Best State for Starting a Limited Liability Company (LLC)

Pros of starting a business in North Carolina

North Carolina offers entrepreneurs a great selection of opportunities to get started on the right foot, with a wide range of support services and incentives ready to help set up shop. Businesses in North Carolina are subject to a low corporate income tax rate of 2.5%, one of the lowest in the country, which is gradually being phased out as part of a more significant trend toward economic growth.

The individual income tax rate stands at 5.25%, but compared to other states it’s still relatively low. Add to that the state’s property tax rate of 0.91%, significantly lower than the national average. You can see why North Carolina is attractive for businesses looking to invest in real estate.

With over 5 million working adults, many of whom have an above-average salary of $54,005 and an unemployment rate of just 3.4%, North Carolina is well placed regarding labor supply. Plus, with the cost of living lower than the U.S. average, running costs should be lower too, making it easier for new startups and small businesses to succeed. And with only $125 needed to incorporate your company, there’s no reason why business owners shouldn’t take advantage of this great environment.

Cons of starting a business in North Carolina

One of the major cons of starting a business in North Carolina is its lack of public transportation. Those without a car might find it especially difficult to get around, as many cities and towns lack reliable options such as subway systems or extensive bus routes.

North Carolina also falls within a hurricane zone and experiences an average of one hurricane every three years. Many areas are also vulnerable to tornadoes, flooding, and severe storms. When natural disasters occur, they can severely disrupt public services such as power and transportation. Properties in coastal areas carry a higher risk of damage from hurricanes and flooding, so it is vital for those looking to purchase a home in North Carolina to have adequate insurance coverage and natural disaster safety protocols in place.

Traffic in North Carolina’s urban centers like Charlotte and Raleigh can be problematic and congested. Additionally, the condition of roads and infrastructure across the state is poor, ranking among the worst in the country. Potholes and other road damage are common; while some areas like the Research Triangle, boast well-maintained roads; others like Charlotte, need much improvement.

The climate in North Carolina can be unpredictable. From early morning chills to a hot afternoon to scattered thunderstorms throughout any given day, it pays to be prepared with various clothing styles – including during spring, when deadly tornadoes sometimes strike.

9. Delaware – Best State for Your Privacy Protection

Pros of starting a business in Delaware

Delaware has become the de-facto destination of choice for entrepreneurs and businesses when it comes to incorporating. With no income taxes on corporations registered in Delaware that don’t do business in the state, Delaware offers some key advantages to entrepreneurs. Firstly, LLCs registered in Delaware are not required to provide member names or addresses in their public filings, protecting your personal information from public disclosure.

The Delaware Division of Corporations reports that 66.8 percent of Fortune 500 companies are incorporated in the state and that approximately 1.8 million corporations have registered in Delaware. These figures emphasize Delaware’s status as a premier destination for large businesses seeking to capitalize on the legal and tax benefits provided by incorporation in the state.

Delaware also offers asset protection from lawsuits; if a party takes legal action against you; Delaware law will protect your assets from being seized. In addition, the First State does not impose any sales taxes, making it a more cost-effective choice for entrepreneurs. Furthermore, Delaware’s Court of Chancery is exclusively devoted to corporation cases – meaning there is a fast turn-around time for filings and decisions. And as an added bonus, Delaware will process same-day filings.

Cons of starting a business in Delaware

One of the main drawbacks of setting up a business in Delaware is the high corporate and individual income tax rates. The corporate tax rate is 8.7% and the individual income tax rate is 6.6%. Despite having one of the strongest state economies in the United States, Delaware does not offer much else as an incentive to locate a business there. Nevertheless, Delaware might still be your top choice if you prioritize asset protection and privacy.

An additional disadvantage when forming an LLC in Delaware is the yearly $300 LLC tax that must be paid. Dual registration may be necessary for businesses that do not operate solely in Delaware, but also in another state, such as their home state. This means filing paperwork, paying fees, and completing other requirements twice, resulting in added complexity and cost.

The tax advantages that make Delaware attractive to investors can rarely benefit small or medium businesses. Small businesses are defined as having fewer than 1,500 employees and annual revenues of less than $21.5 million. Therefore, if you don’t fall into these criteria, it may be harder to reap the benefits of incorporating in Delaware.

10. Idaho – Best State for Real Estate

Pros of starting a business in Idaho

Idaho is the perfect place to start a business; it’s one of the most business-friendly states in the country, with a low risk of natural disasters, ample supply of skilled labor, good infrastructure, and a regulatory environment that isn’t too strict. Taxes are also kept low, with both personal and corporate income tax rates of 6.93%. Additionally, the cost of doing business is slightly higher than in other states, putting Idaho on the lower end of the list.

The state is also known for its strong economy and real estate sector, making it an ideal home for any new business looking for a safe physical environment with vast untapped potential. Idaho is also one of the fastest-growing states in the U.S., offering newcomers an excellent opportunity to succeed in their chosen field of business.

When starting a business in Idaho, you can be sure of a warm welcome from the local community and access to useful resources such as business mentorship programs, funding opportunities, and tax exemptions available to entrepreneurs. With everything in its favor, there is no better time than now to launch your next big venture in the Gem State!

Cons of starting a business in Idaho

Idaho is one of the fastest-growing states and offers a healthy supply of skilled labor, good infrastructure and the regulatory environment isn’t too strict. When it comes to taxes, both personal and corporate income tax rates are 6.93%. The cost of doing business is also a bit higher, placing Idaho toward the lower end of our list.

5 Worst States to Start a small business in 2024

It’s time to take a closer look at the states with the worst conditions for starting a business come 2024, and why that might be. As we did for the most conducive business states, we carefully evaluated this set of factors to reach our conclusion.

1. New York – Cost of Living High State

New York is the undisputed financial capital of the United States, and home to some of the most successful and innovative businesses in the world. But don’t be fooled – the high costs of living and doing business in the Empire States make it one of the worst states to start a small business in.

Individual state income taxes are high at 8.82%, with a corporate rate of 6.5%. That’s just the beginning – if you’re looking to get your business off the ground in New York, expect steep fees for permits, licensing, and other paperwork required to do business. Commercial real estate will cost more than most places in the US, making New York one of the most expensive places to rent or buy office space. Plus, inadequate access to financing means most small business owners will have to fund their endeavors out-of-pocket, which makes cutting costs even more difficult.

While all this adds up to a pretty significant risk, it also means that those who succeed in New York can also enjoy great rewards. With almost 20 million people living in the state, access to a large consumer base is practically guaranteed. Plus, market visibility tends to be higher in a city that never sleeps, so opportunities for growth and success abound for those brave entrepreneurs willing to take the plunge.

2. Vermont – State of Aging Workforce

Vermont may be one of the worst states to start a small business, but it’s not without its potential. With corporate and individual tax rates at 8.5% and 8.75% respectively, Vermont is among the highest in the nation for taxes. Finding financing can be difficult due to a lack of investors and venture capitalists flowing into the state, but there are a variety of government grants and loan programs available.

Another issue that Vermont faces is an aging workforce, which has caused labor shortages over the years. This makes it hard to find quality workers and can be a strain on businesses with limited budgets. Despite this, almost half of all new businesses survive five years in Vermont, with some going on to become successful companies that contribute to the state’s economy. With the right amount of dedication and creativity, you can boost your chances of success in this beautiful yet challenging state.

3. New Jersey – Worst State in the US for Tax Purposes

The state of New Jersey has long been known for its deep-rooted commitment to quality education, and this is reflected in the numerous reputable higher education institutions found within its borders. With such a wealth of top-tier educational opportunities comes great potential for workforce growth and development, including a highly skilled and specialized labor force that can bring many benefits to local businesses in a variety of industries.

However, the allure of such a talented workforce comes with a steep price tag. Coupled with the already high cost of living associated with the Garden State, employers will have to pay their workers even more than those of some other states.

Regarding taxes, New Jersey is one of the worst states to do business in. For individuals, the state has an income tax rate of 10.75%, higher than neighboring states such as New York. This can be a significant burden for would-be entrepreneurs and those looking to live and work in New Jersey.

The corporate tax rate, meanwhile, sits at 9%, and it’s no surprise that businesses may find themselves dissuaded from setting up shop here. Compounding the problems caused by high tax rates is the high cost of the business in Garden State.

Overall, New Jersey remains an attractive destination for students seeking higher education, but its stringent taxation system keeps it from being an ideal place for new business owners.

4. Hawaii – High Cost to Do Business

Doing business in Hawaii can be a daunting task. Despite the state’s beautiful natural attractions, running a business here comes with numerous challenges.

When considering Hawaii for business opportunities, potential entrepreneurs need to evaluate the financial risk of doing so. For many businesses, the one-year business failure rate stands at 25.4%, one of the highest across the country. This is far higher than the average annual business closure rate across the United States.

One of the main reasons for these failures is the difficulty of finding skilled labor in Hawaii. There are limited educational facilities on the islands and qualified personnel can often be hard to come by. Additionally, raw materials necessary for conducting business tend to cost more than in other states. Furthermore, a corporate tax on profits is much higher than in other parts of the country, making doing business in Aloha State even more challenging.

Though there are significant difficulties associated with running a business in Hawaii, setting up a shop here still has its benefits – primarily when entrepreneurs are involved in industries related to tourism or hospitality. Local demand is often relatively high in these areas and, if managed properly, businesses can succeed provided they overcome the issues discussed above.

5. Rhode Island – Worst Overall State for Business

Rhode Island has the oldest infrastructure in the United States, with roads and bridges that are often inadequate for today’s needs. This can be a major impediment when trying to build or launch a business in Rhode Island. The cost of real estate is also quite expensive in Rhode Island, which makes it difficult to find space suitable for new businesses.

Additionally, wages are high in Rhode Island, as labor costs make up a significant portion of any start-up budget; making it significantly harder to compete against businesses with more established resources.

The population of Rhode Island (just over 1 million) is small compared to other states, so the supply of quality labor is decreasing rapidly. This can make it very difficult to find enough qualified workers needed to start and run a successful business. Further exacerbating this issue is the fact that consumer spending in Rhode Island has been steadily declining, making launching a business more difficult than ever before.

Ultimately, the combination of these factors has made it exceptionally hard for businesses to succeed and thrive in Rhode Island. According to data, only about half of all businesses in Rhode Island survive their first five years, underscoring just how hard it can be to operate here.

What We Considered to Rank the Best and Worst States for Starting a Business

Aspiring entrepreneurs have countless options when starting a business, and the decision can be difficult knowing there are so many factors to take into consideration. Every state presents unique opportunities for budding business owners. Each has its own advantages and disadvantages based on criteria such as cost of labor, privacy protection, and cheap real estate. Keeping in mind your individual needs for a successful business and doing your research on which state best suits them is a great start to making the dream of owning your own business a reality.

When it comes to deciding which state would make the best place for your business, there are a number of factors to consider. We’ve compiled a list of criteria that we used in our evaluation process, so you can be sure you’re making an informed decision:

Tax rates: The taxes you pay will heavily influence the profitability of your business. Higher individual and income tax rates directly reduce your ability to reinvest in and grow your venture.

Business survival rate: The statistics speak for themselves. This metric gives you an indication of how likely a new business is to succeed in any given state.

Cost of doing business: Unsurprisingly, this factor determines the commercial sustainability of your venture. Without proper cost coverage, you may find your business won’t last long after launching.

Workforce: A young and capable workforce is key to any successful business environment. As well as having the skills necessary for success, growing workforces also tend to bring lower costs of labor.

Regulatory environment: Every state has its own laws when it comes to welcoming new businesses. Regulations vary from country to country and range from fairer policies for small businesses to more taxing ones.

Risk of natural disasters: Natural catastrophes can happen at any time and their unpredictability means you should always plan ahead. Climate change has increased the risk of natural disasters across the US, meaning some states have higher chances than others.

Conclusion

Starting a business involves countless considerations, and location is just one factor, and there’s no one-size-fits-all answer for where entrepreneurs should set up a business. However, by understanding the local tax rates, access to financial resources, and other key factors of various states across the country, business owners may have more tremendous success in getting their businesses off the ground. With the right tools, dedication, and an eye for the details, anyone can start their own business today.

For those determined entrepreneurs, head over to The Billion Stories guide on how to start a business and get the jumpstart you need.

Leave a Reply